Birmingham City Council

We write with reference to a letter which has been sent to you by Birmingham Perry Bar MP Ayoub Khan. We understand that it outlines the arguments we have made and the action plan we suggested to deal with the huge overpayments by Birmingham City Council in employer’s contributions to the West Midlands Pension Fund (‘WMPF’). So we will not repeat all of the points here.

We understand from comments made by your officials in response to media inquiries by ITN covering this story that they have advised you do not have powers to intervene as we have suggested.

We can only assume this was a holding response pending further investigation as to these powers, because we would assert that you most definitely do have these powers on a number of levels and we would urge you to use them to prevent the escalation of the Local Government Pension Fund Scandal which is emerging.

We initially refer you specifically to the first page of the Local Government Pension Scheme regulations 2013, Regulations 3, 3A and 3B

Indeed it was specifically the failure to intervene under such by Messrs Michael Gove, Robert Jenrick, and Sajid Javid as your immediate predecessors as Secretaries of State which caused the scandal to emerge and escalate.

We believe it is imperative for you as Secretary of State to separate yourself from their prior actions and failures to act which were motivated specifically by Tory ideological policies in this area. This will enable you to reset the whole landscape of local government pension funds across England and Wales.

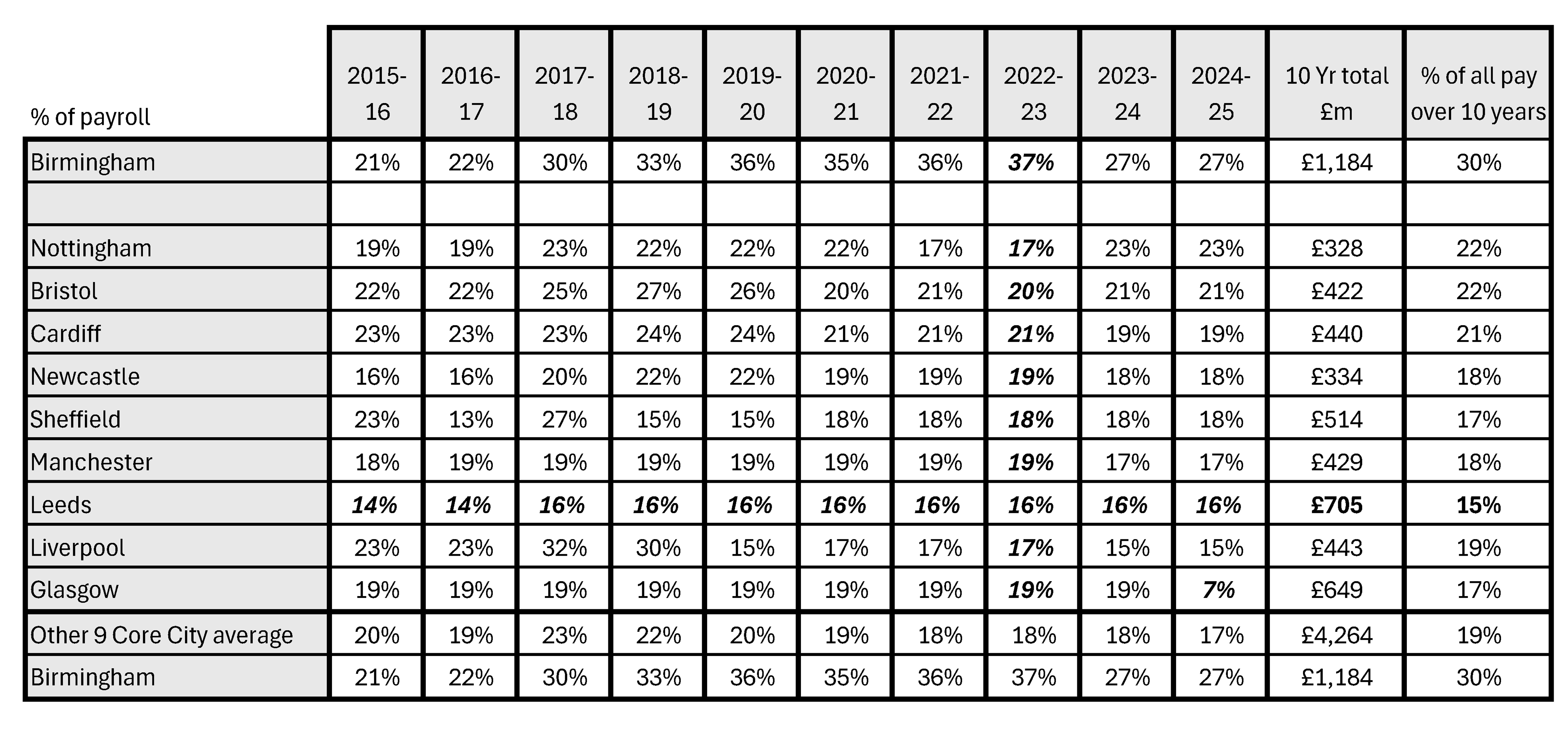

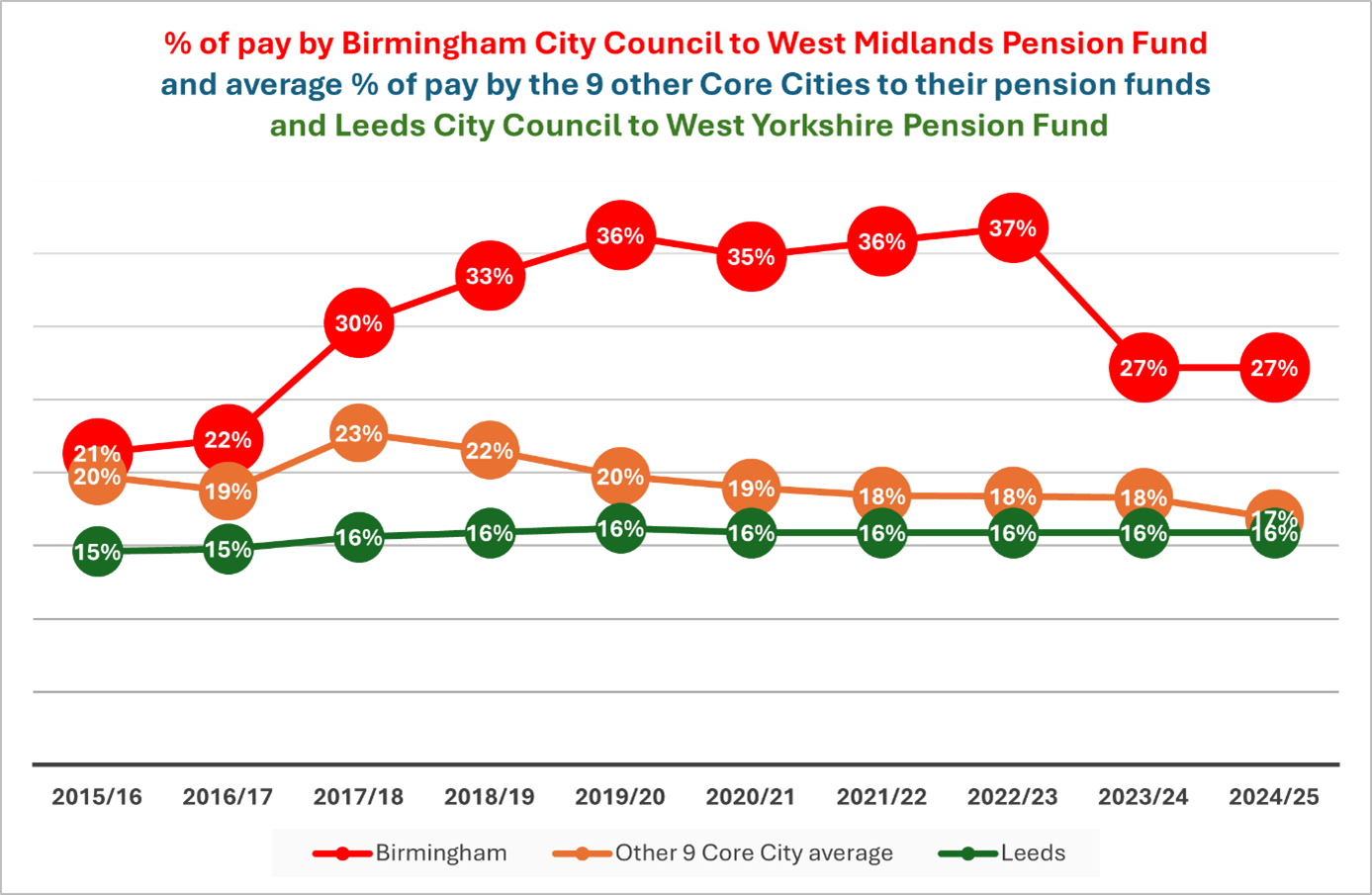

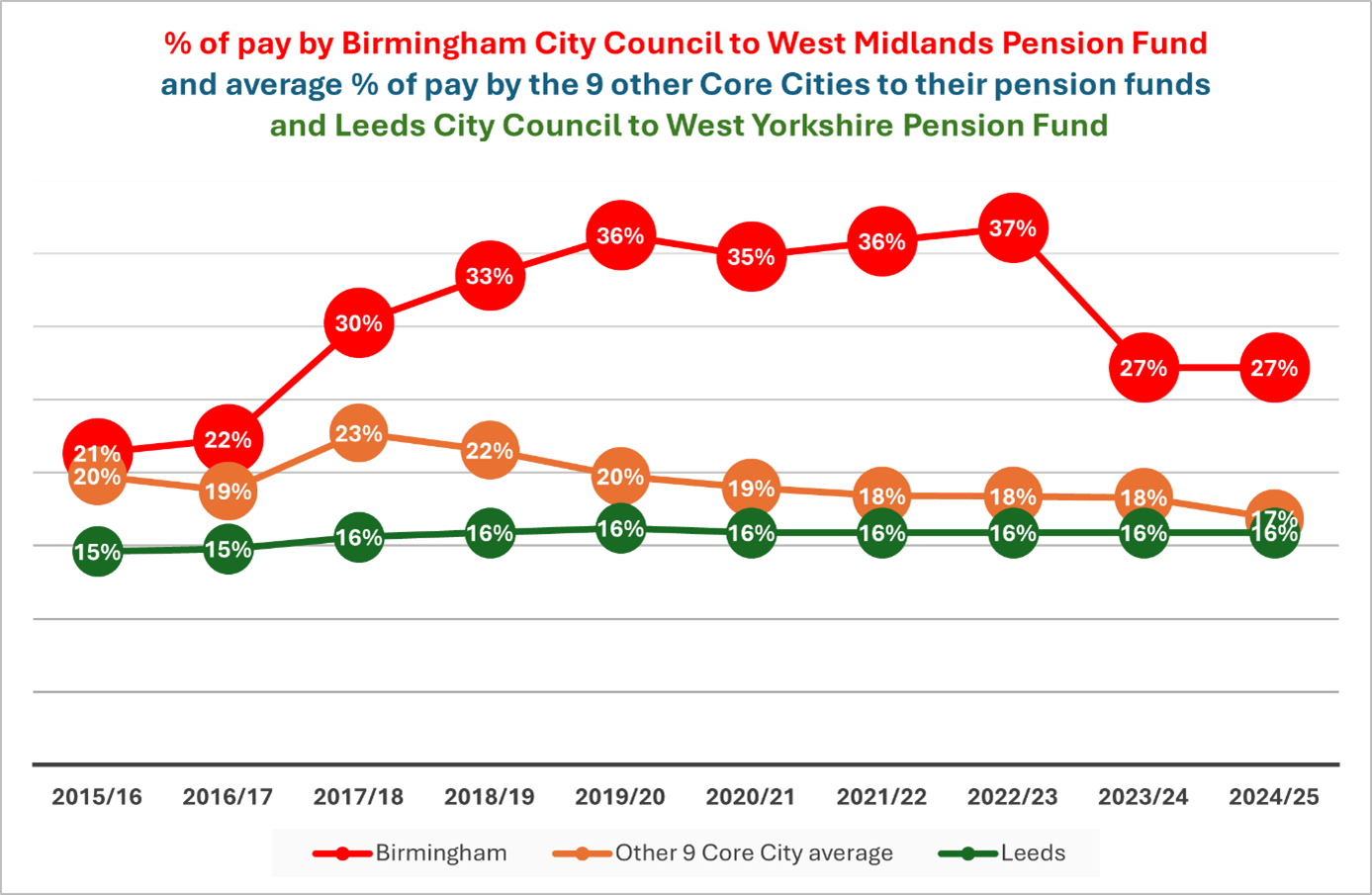

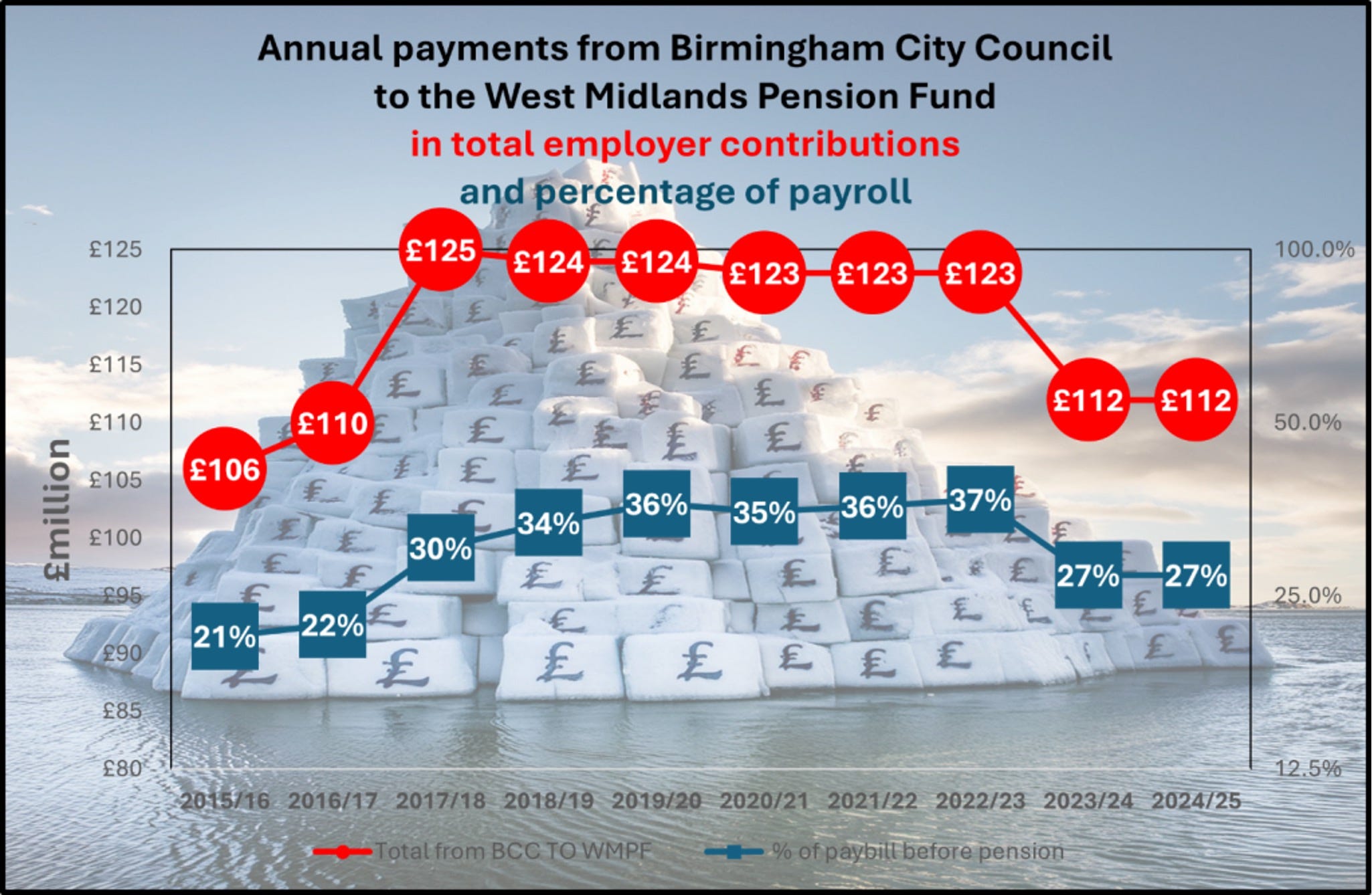

It very specifically impacts in Birmingham because it was the failure to intervene which caused an extraordinary series of overpayments to be made in employer’s contributions, especially since 2019 and peaking 2022-23 with the City Council being required to pay 37% of its employees’ salaries in pension contributions. You will see from this table that this was literally extraordinary compared to the other 9 core cities of the UK.

It was in fact these exorbitant payments which caused Birmingham City Council to issue

its notice under Section 114 (3) of the Local Government Finance Act 1988 on 5th September 2023. Had these overpayments not been made there would have been sufficient revenue headroom to avoid it, and the intervention ordered ironically by Michael Gove, one of the chief architects of the Local Government Pension Fund scandal, which resulted in these overpayments in the first place.

Specifically, it was the failure of the aforementioned Secretaries of State to consult with the Government Actuary's Department and/or others and then issue specific guidance to local government pension funds and their actuaries as to the discount rates being applied. These were clearly resulting in quite ridiculous, illusory and unsustainable estimates of liabilities in the funds, thence leading to some funds requiring similarly unsustainable and inappropriate requirements in employers' contributions. Birmingham City Council was the canary in the mine indicating that the system had broken down and was not fit for purpose.

As we predicted in 2022 this would eventually lead to eye-wateringly large surpluses in the pension funds arising in a matter of 18 months. And so it came to pass. By 2023 in the West Midlands (in the space of a year) the liabilities for the purposes of IAS 26 reported by the WMPF's actuaries had fallen by £7.8 billion: from £27.5 billion in 2022 to £19.7 billion in 2023. This meant that the pension fund was in balance and fully-funded.

In March 2024 the pension fund declared an IAS 26 surplus of £1.5 billion. As the discount rate used for accounting liabilities and the funding strategy technical provisions have now equalised, and indeed have crossed over, then in 10 weeks time the fund is likely to declare a surplus under both systems of at least £4.5 billion pounds.

Hence the need for immediate action by the Secretary of State to counter previous failures by previous Secretaries of State as far back as 2010.

Because the triennial actuarial valuation took place in 2022 employers were still being asked to pay contributions based on those previous calculations. There should have been an immediate intervention by the Secretary of State setting guidelines requiring inter-term valuations, and so recertifications of employers' contributions under Regulation 64A of the Local Government Pension Regulations 2013.

Indeed, guidance under Regulations 3, 3A and 3B of the Local Government Pension Scheme Regulations 2013 in consultation with the government actuary's office and others should have been given by successive Secretaries of State since 2010 when the discount rates emerging from ultra-low interest rates in the context of quantitative easing came close to zero. A floor in discount rates at 7% over that entire period would likely by 2023 have led to fully funded schemes over the same period and have resulted in consistent steady contributions by employers during that time.

In addition, the Secretaries of State should have issued guidance under the same Regulations 3, 3A and 3Bas to investment management at the funds. Because liabilities were being reported at an unsustainable and illusory level, this led to the funds chasing huge returns using international equities investment on the asset base (and at great risk) when much safer derisked lower returns should have been used.

This also led to huge investment management fees being charged to taxpayers, with staggering increases year on year. This became a vicious circle as these were being deducted from the assets of the fund and so increasing deficits and so increasing employers' contributions.

This was the case across the United Kingdom. In 2024 the management expenses of all the funds in the United Kingdom were £2.5 billion in one year. £2.1 billion of this was in the England and Wales local government pension funds.

If there is not intervention, or (we believe unnecessary) legislation enabling intervention, then over this five year parliamentary term management expenses in the pension funds will be at least £12.5 billion of taxpayers' money. That will be as a result of a choice by the government NOT to intervene as apparently (on the basis of the media briefing) currently being advised by your officials.

We would assert that the failure of Tory Secretaries of State to intervene was based upon an ideological decision of laissez-faire towards these funds being part of "the market", and for market forces to determine what happens in them. This was extremely naïve, because government intervention since 2010 had created a false market from which false discount rates emerged. We also said that successive Secretaries of State were quite happy from a political point of view for investment managers to receive the scandalously high expenses last year of £1.8 billion in England and Wales.

On the wider issue of practice and procedure in local government pension funds in England and Wales you have clear powers to issue guidelines and should do so now as a matter of urgency, in any event. We also believe that you have effective control as Secretary of State of these pension funds and you should seek further independent advice as to your present powers to intervene generally and/or specifically in funds and in councils with regard to their pension funds. You should also consider emergency secondary legislation enabling you to do so until full legislation can be introduced to enable ongoing intervention.

We would assert that these are quasi-sovereign wealth funds dispersed across England and Wales, which are barely touched by the payment out of pensions, and legislation should reflect this. Last year the annual pensions paid out by all of the funds in England and Wales were 98.5% funded by the contributions coming in from employers and employees. The asset base of £391 billion exists essentially for an unnecessary annual calculation of liabilities, and to be feasted upon by the markets.

As to your powers in Birmingham, it is inconceivable that you have been advised you have none, and the media briefing must have been based on wider issues. As Secretary of State you are effectively able to direct the council and through your Chief Commissioner Max Caller can do so. You should instruct your Chief Commissioner to instruct Birmingham City Council to request an immediate and expedited recertification of its contributions by an independent and newly-appointed actuary.

The debilitating cuts which are effectively austerity 2.0 in Birmingham are about to be agreed by its City Council. Working out the new contributions based on the huge WMPF surplus share (likely in its accounts this year of £1.5 billion) can be expedited and should take weeks, not months.

The council have given a statement to ITN that they are essentially relying on the normal course of events and allow for the normal triennial valuation to take place, which will take "several months". If it was initially solely for Birmingham City Council as one employer, it most certainly would not.

Bearing in mind the huge overpayments, we would suggest that the council has already paid the next three years employer's contributions in full and a negative secondary contribution figure should be applied to reflect this, thus resulting in an employers' pension holiday for the next three to four years.

Each month Birmingham City Council has to stump up £3m as its share of the WMPF's investment management expenses. It is considering closing 4 day centres for the disabled, and selling the land they are presently upon, to save £100,000 a month. This is at the heart of the scandal.

The council should be advised to pause the cuts and be given extraordinary permission (or temporary government funding, if necessary) to introduce a later emergency budget once revaluation has taken place.

We would be happy to meet you to discuss this further.

Professor David Bailey

University of Birmingham Business School

Professor John Clancy

Birmingham City University Business School

Angela Rayner Photo © UK Parliament / Maria Unger, CC BY 3.0 <https://creativecommons.org/licenses/by/3.0>, via Wikimedia Commons, resized

<

.jpg)

John Clancy and David Bailey

John Clancy and David Bailey