Blogs from the Blackstuff

Professor John Clancy and Professor David Bailey

Blogs from the Blackstuff

Blogs from the Blackstuff

Blogs from the Blackstuff

By Professor John Clancy and Professor David Bailey

30th June 2025

Breaking News :

Birmingham City Council IS owed at least £1.3Billion by its pension fund.

Chief Commissioner has lost all authority.

Birmingham City Council IS owed at least £1.3Billion by its pension fund.

Chief Commissioner has lost all authority.

edit 28/07/2025:

We had no other option but to use the last available accounts in 2022 to roll forward our figures from in calculating our estimate here: the ex-Chief Commissioner had forbidden any accounts to be published since then.

In the 2025 just-published Birmingham City Council accounts, Birmingham's share of WMPF's accounting liabilities is judged to have increased, whilst its share of the assets is judged to have fallen. There is no explanation for this. But (spookily) it handily significantly reduces the surplus to £0.7B.

Even slight swings in these shares cause significant changes.

As it happens, as we have pointed out, the Government Actuaries Department (GAD) has warned that local government pension funds are significantly underestimating their returns which over the medium to long term are maintaining a 7% return, but funds have been using 4% .

So for funding purposes (as opposed to accounting purposes, which uses the corporate bond rate) if recertification took place now, and the GAD advice was followed, the liabilities would be 23% lower than the 2025 liabilities (i.e. £13.2 B).

This would leave a surplus for Birmingham City Council of £1.8 billion.

WMPF would have a surplus of £8.2billion.

In that context,Please read on!

But first, the headlines:

- Minimum £1.3 Billion surplus in Birmingham City Council pension fund confirmed in just-out West Midlands Pension Fund accounts 2024/25.

- Pension fund managers deducted from the fund and paid out £130M in expenses for just a 2% investment return last year on its £20Billion of assets invested – whilst stock markets soared.

- It turns out Birmingham was never ‘bankrupt’ in the first place.

- Chief Commissioner proven unable to understand local authority pension funds.

- Max Caller has lost his authority and must resign or be sacked.

- Failure of government to intervene proves catastrophic for Brummies

- Huge hikes to Birmingham's council tax completely unnecessary.

It’s here in black and white:

Meeting documentation here

1. The sums

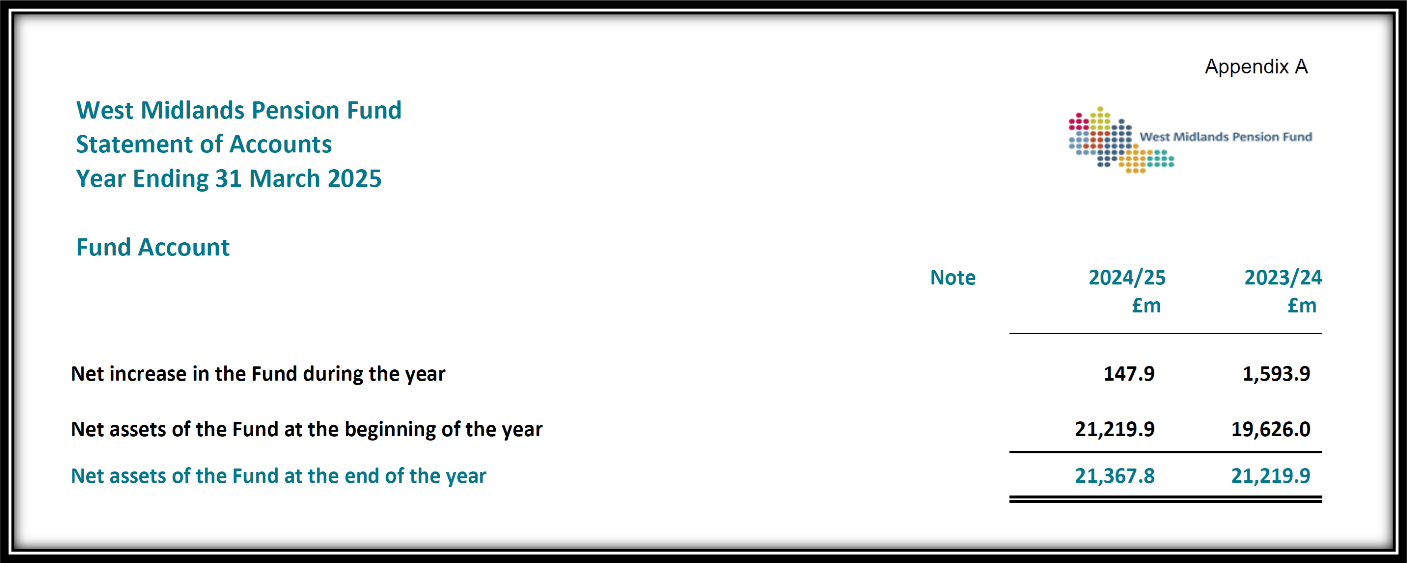

On the 31st of March 2025 the West Midlands Pension Fund valued its assets at £21.4Billion.

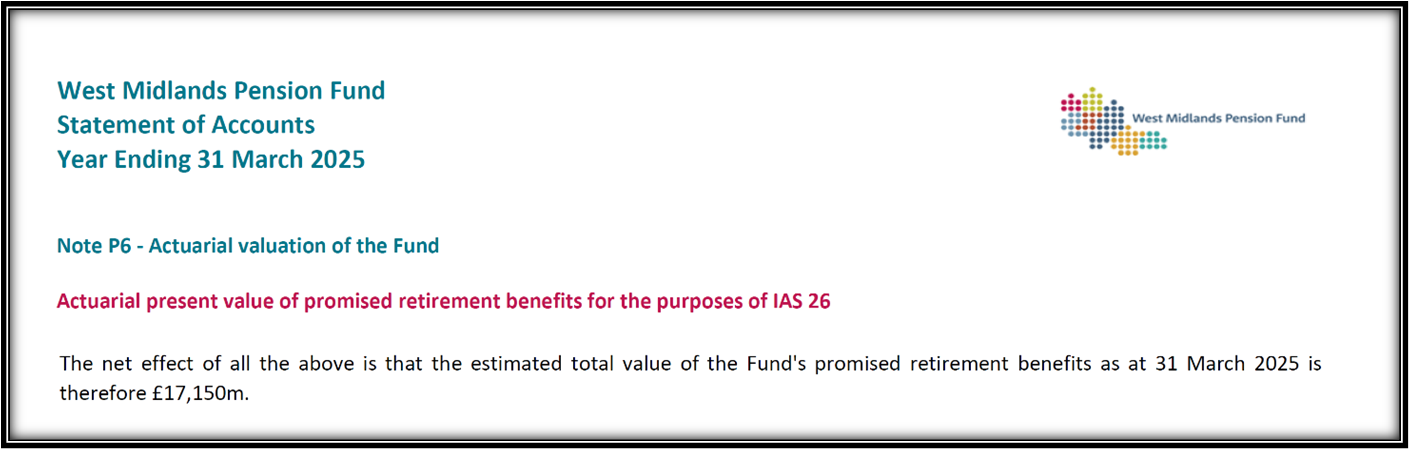

Its accounting liabilities were valued at £17.15Billion.

Consequently it is in surplus by

£4.3 billion.

Birmingham City Council’s own pension fund is 30% of the West Midlands Pension Fund. So Birmingham is owed

£1.3 billion

by the West Midlands Pension Fund.

And counting….by the day.

And the law is crystal clear: a surplus in a defined benefit pension scheme where the employees' contributions are fixed is owned by the employer. The employer is entitled to ask for this back - in a council's case, to be paid into revenue.

We warned the chief commissioner Max Caller last December that the pension fund was massively in surplus by many £100millions. It had paid massively too much money to the pension fund.

Birmingham City Council was entitled to, and could have already claimed, the return of those surpluses into revenue starting before the new financial year in April 2025, using recertification under reg. 64(A).

He publicly ridiculed us, calling us ‘financially illiterate’.

He had to be right about this. But he was very, very wrong.

So now there is proof that the council he was meant to be ‘saving’ only ever needed ‘saving’ because its pension fund owed it £1.3 billion.

2. The hidden accounts

City Councilors and Brummies should have been able to see this - because what was happening would have been clear from the City Council’s accounts. But the chief Commissioner gave orders that these should NOT be seen.

The council’s accounts have not been published since 2022 on his orders, and the pension fund section of the accounts similarly not published on the spurious grounds that the Oracle computer system could not be trusted. The pension fund section of the accounts are set externally by an actuary. They have nothing to do with the Oracle computer system and could have been published separately.

For these reasons we are formally calling for the resignation or dismissal of the Chief Commissioner of Birmingham City Council, Max Caller.

We believe that the boss of the West Midlands Pension Fund, Rachel Brothwood, similarly must go. The fund asked for extraordinary, unsustainable employer contributions from Birmingham City Council. Their own accounts now show they were completely unnecessary and due to spectacular miscalculations by the fund.

You might think a surplus is good news. It is not. In a defined benefit contribution fund the assets and liabilities should balance. A surplus of this size indicates incompetence, not success.

It means the employer was asked for far too much in employer contributions, And also that the funds were probably put at too great a risk.

4. Cut Bin Workers' wages, but manage to hand £40million to bankers for a 2% return on investments

And what on Earth was the West Midlands Pension Fund doing obtaining just a two per cent return on its £20 billion investment last year, whilst handing over an increased £130M in management expenses, almost entirely in investment management expenses to bankers?

Birmingham’s share of those expenses was £40 million - for a 2% return on investments!

The regulations allow investment managers to be dismissed on three months notice for no reason. They should be.

Chief Commissioner Max Caller (let's not pretend he doesn't actually run the council) should also have cut or cancelled these massive expenses of the City Council’s pension fund investment managers before he recommended cuts to the wages of its bin workers.

And certainly before he ordered ongoing cuts of £250m to council services; never mind being owed £1.3billion, unnecessarily taken from revenue by its own pension fund.

5. The Surplus is probably much bigger, and must come back before next March.

We believe that the surplus will likely be even higher in the valuation currently underway. The accounts figures above are without question just a verifiable, baseline, minimum figure. The fund will find it difficult to dispute.

And as the Chancellor of the Exchequer has now ordered that the entirety of the West Midlands Pension Fund’s assets be handed over to one of the new six regional mega-funds as soon as next March 2026, a further accounting procedure will have to take place in the next three months.

This will be since March 31st 2025 and will show the surplus likely to be heading towards £2Billion in Birmingham alone.

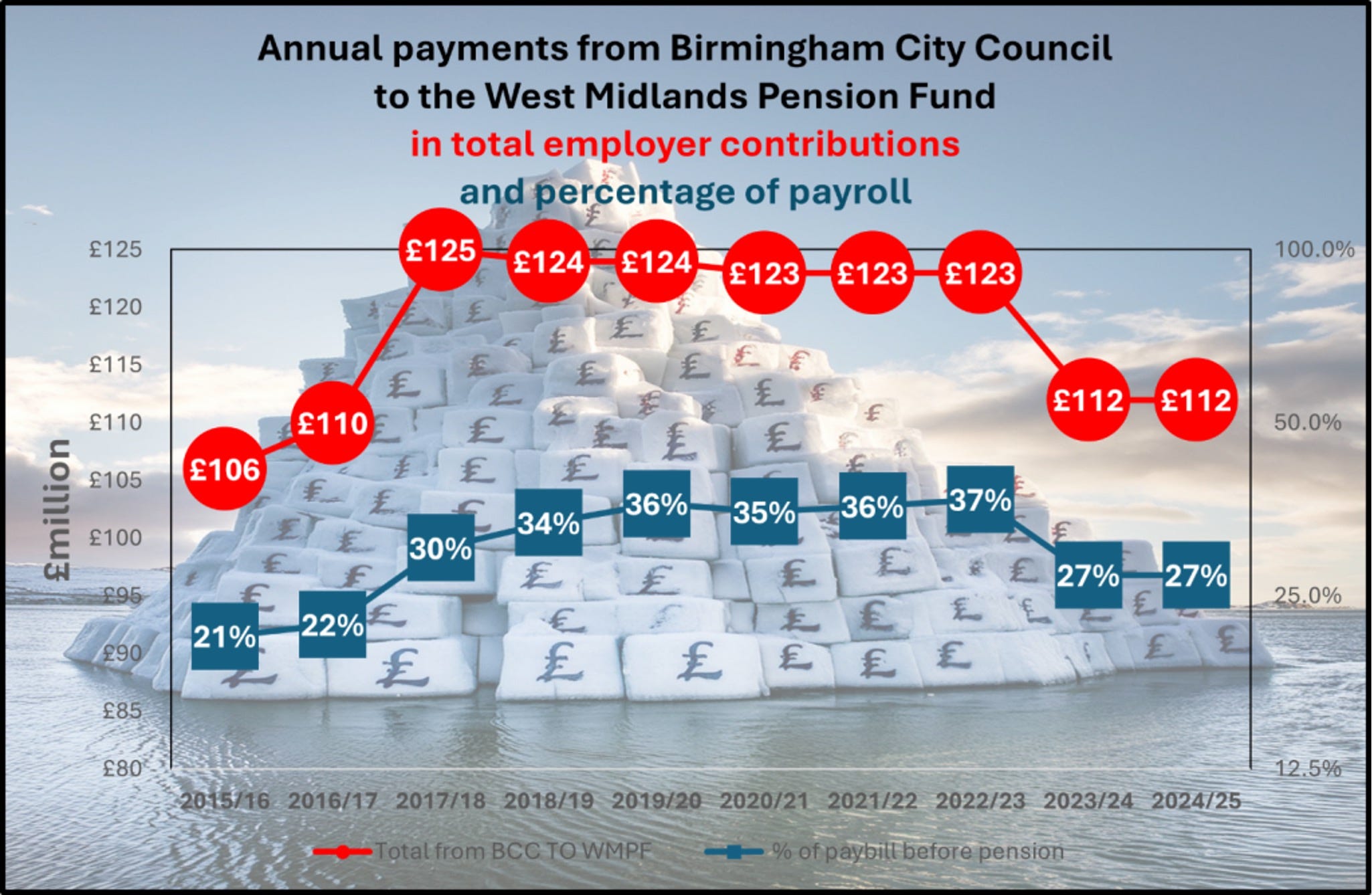

Birmingham must insist that that a reckoning-up is done before those funds are handed over - and bearing in mind the Council is still unnecessarily paying £120million a month in employer contributions (since the beginning of April 2025) the City Council as employer will be owed much more.

6. A Reckoning - now

Steps must urgently now be taken to ensure the council gets fully what it is owed.

But clearly Max Caller no longer has the authority or standing to be able to do even this.

We also believe that the West Midlands Pension Fund's draft accounts should be independently audited and verified to check this year’s figures in their draft accounts. And not by their current auditors. We could very well find that more is owed with an Fresh, independent eye cast over them.

And also, let's not entertain the nonsense of the surplus being gradually returned to Birminghamover the next three years in installments. It's simply too big. The WMPF will effectively be gone next March. IT IS NOT A LOAN.

This loss of £1.3Billion to Birmingham has affected every household in the city. In fact, with 423,500 households in the city, that's £2,800 per Brummie household.

And counting.

.jpg)

John Clancy and David Bailey

John Clancy and David Bailey