By Professor John Clancy and Professor David Bailey

Last financial year 2023-24 the Birmingham Children's Trust, the spin-off charitable interest company which runs children's social services, including services for vulnerable children and those in care in the city, spent £70million on employees' salaries.

This was obviously mainly to the people doing the toughest job in the city - our children's social workers.

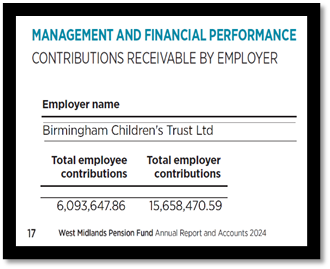

But, once the £70million was paid out to them, the trust also had to add the payments in employer contributions for their pensions. The amount was determined, required by and sent to the West Midlands Pension Fund, which the trust is a part of.

What they had to pay out that year (and the 2 years after) was determined early in 2023, in the 31st March 2023 valuation of the pension fund. Here's the relevant bit.

So the trust had to add from its budget a further 22.6% of the payroll of £70 million, that's £15.7million.

With the pay award of 4% this coming year, the employer contribution will be £16.3million.

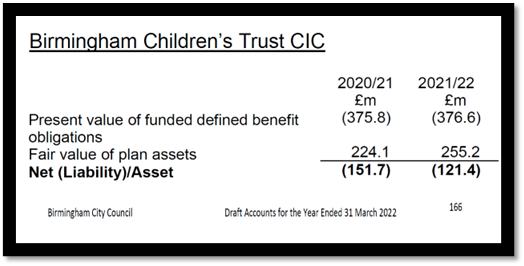

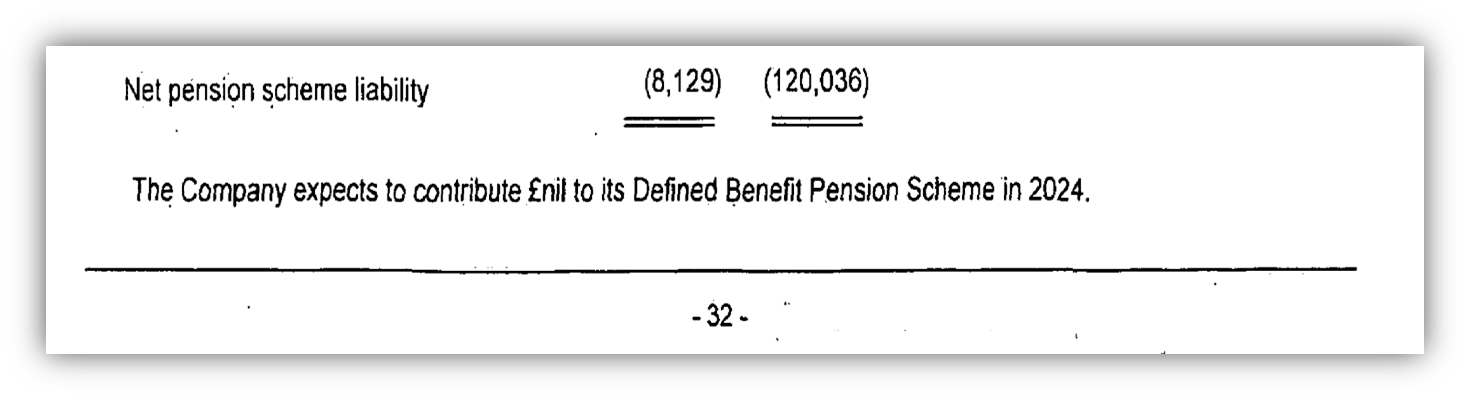

In the 2022 accounts, the Birmingham Children's Trust pension position is set out.

The accounts show us how much is owed by the Trust in pensions at that date, and then what the Trust has in assets at the WMPF in to cover that pension obligation.

So on March 31st 2022 the pension fund at the children's trust was £121million in deficit.

However, the signs were already there - that deficit having fallen by 20% in one year.

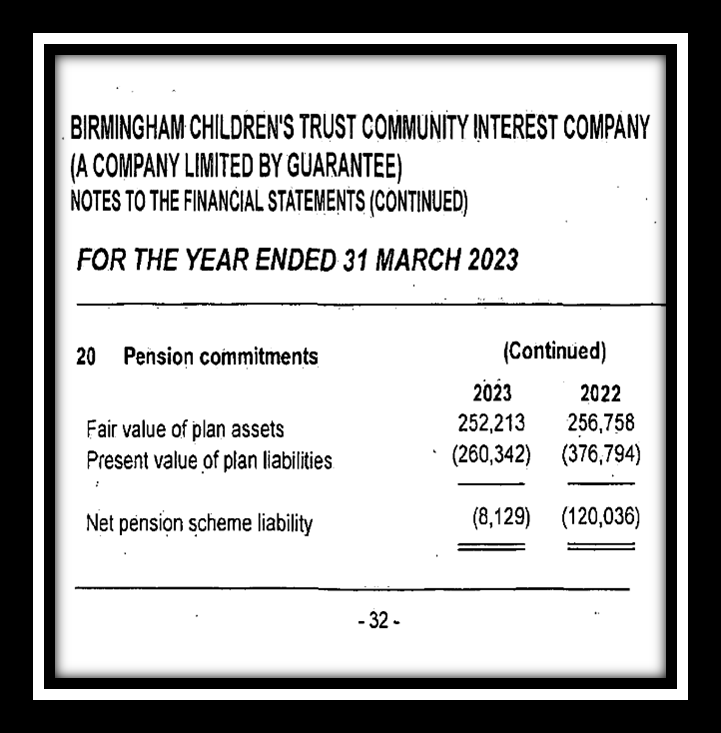

For the following year in 2023 we have to rely on the figures given in the accounts submitted to Companies House.

This is because Birmingham City Council hasn't published any accounts since 2022, despite repeated requests to the chief commissioner Max Caller Limited, he has refused to reveal for absolutely no reason at all the pensions accounts, ridiculously citing the Oracle computer problems at the council, which obviously had no impact on the pension fund position. (What on earth is he trying to hide?)

So the £152million 'deficit' on March 31st 2021 only two years later spiralled down in a tailspin to £8.1 million. In other words, it fell by 96% in 24 months by March 31st 2023 – this is the date of the valuation in which WMPF set the Trust's employer contributions from 2023 to 2026.

WMPF thought the trust's deficit was a huge family pizza made of 20 slices. They had to remove 19 of them. Because they got their figures and estimates simply wrong.

It was certainly nothing to do with excellent performance in the assets of the fund. In fact, the investment managers managed to lose 1.8% of the fund in 2023: the Trust was £4.5million down on the deal.

And here's the other aspect of the scandal here: the Children's Trust effectively currently hands over £2.3 million each year to the uber wealthy investment management companies of the City of London, Wall Street and international fund management companies for 'looking after' its Pesion Fund assets.

It's impossible for the WMPF to say they did not know that the liabilities (accounting or otherwise) had fallen so dramatically. Because the discount rate of 4.75% used for the accounting liabilities in 2023 had suddenly started to equalise (and overtake) their own FSS expected rate of return discount rate. So they had to know whichever way you skinned the cat the deficit had fallen by 95%.

A curious aside is one sentence from the Trust's 2023 accounts at Companies House:

Somebody at the trust was presumably going to get a rather nasty surprise when instead of assuming they were paying nothing in 2024, they were asked instead to pay £16million? Or perhaps the figure in the 2024 WMPF accounts was a notional figure and they were let off!? We suspect not. We will try to get the trust to clarify whether this was just some mistake, surely.

But (as with Birmingham City Council itself) the WMPF effectively pretended that nothing had happened, and stuck to their 2022 figures, and (would you believe?) actually increasedthe Trust's employer contributions! 23% of the children's trust payroll was their new increased figure and they were sticking with it.

Carry on Regardless from Sid James and Hattie Jacques up at West Midlands Pension Fund.

But it got worse.

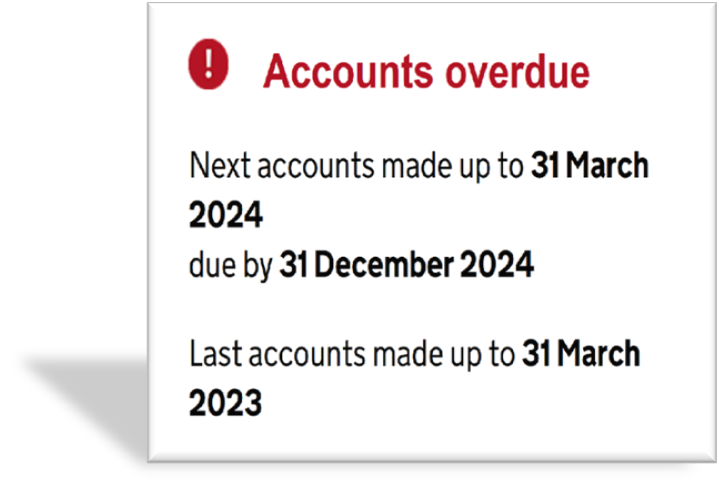

We don't have the 2024 accounts from the Children's Trust pension fund itself – Companies House tells us the following:

Although we do understand from Companies House that the account was submitted yesterday 24th February 2025, but will not be available online for 10 further days.

We know, however, from the 2024 wider pension fund accounts that the assets in the Children's Trust pension fund (the Trust is 1.3% of the whole fund by itself) must have increased to £266million, and its liabilities steady at £247million

So the Children's Trust pension fund was actually in surplus by almost £20million last March 31st 2024.

Bear in mind that the entirety of the employer contributions was £16million.

Had the Children's Trust been required to pay 0% last year 2023/24, the fund would still have had £4m more than it needed.

Now that is a scandal.

What would the Children's Trust have spent that £16million on?

And if nothing changes it's going have to pay another £16.4 million this coming year from April 1st 2025! So what could they have spent that £32.4 million on?

Well it's only 5 weeks until these calculations have to be done all over again. And we can assure you it's going to add to the scandal.

On the basis of the sensitivity figures given in the 23-24 annual report &accounts for the WMPF, and using PWC's most recent pensions accounting trends figures, our estimate for the Children's Trusts liabilities in five weeks time is £222million. We estimate that the assets will have risen to £293million.

That means there is likely to be a stonking great surplus on 31st of March 2025 in the Children's Trust pension fund of:

£71m

That surplus means that the Children's Trust has effectively already paid the employers contributions for this and the following three years.

Instead, this coming year (as this last year) the fund is stubbornly still asking them to pay 23% of its payroll, likely £16.4 million, which will add to that surplus!

You have to agree that this is getting ridiculous.

These overpayments are taken as credit in order to reduce or cancel out completely future employer contributions.

More serious in this context, in addition to the unnecessary £16.4 million this coming year in employer contributions, is that the trust needs to cut £23 million from its spend this year, in one year, under orders from the council?

Labour councillors have to ask themselves whether they are personally prepared to allow this ridiculous situation to continue and so continue to impact the lives and life-chances of vulnerable children in this city.

This £71 million is ready to return now, and should be brought back into revenue and spent on children's services now, to protect vulnerable children in Birmingham.

.jpg)

John Clancy and David Bailey

John Clancy and David Bailey