Blogs from the Blackstuff

Professor John Clancy and Professor David Bailey

Blogs from the Blackstuff

Blogs from the Blackstuff

Contact us

Blogs from the Blackstuff

Get In Touch.

Message Us

Contact Info

By Professor John Clancy and Professor David Bailey

5th June 2025

Labour’s £200 billion blunder

One of the worst mistakes of any incoming Labour government.

A Scandal.

Short-form blog.

Full detailed blog here.

One of the worst mistakes of any incoming Labour government.

A Scandal.

The pension scheme for some of the poorest people in the UK (75% are women, paid an annual average pension of just £3,600) is the Local Government Pension Scheme (LGPS). Inexplicably, it is a private, but actually public sector, pension fund (actually, again inexplicably 97 separate funds).

Our research shows that it now has a scandalous surplus of £200 billion.

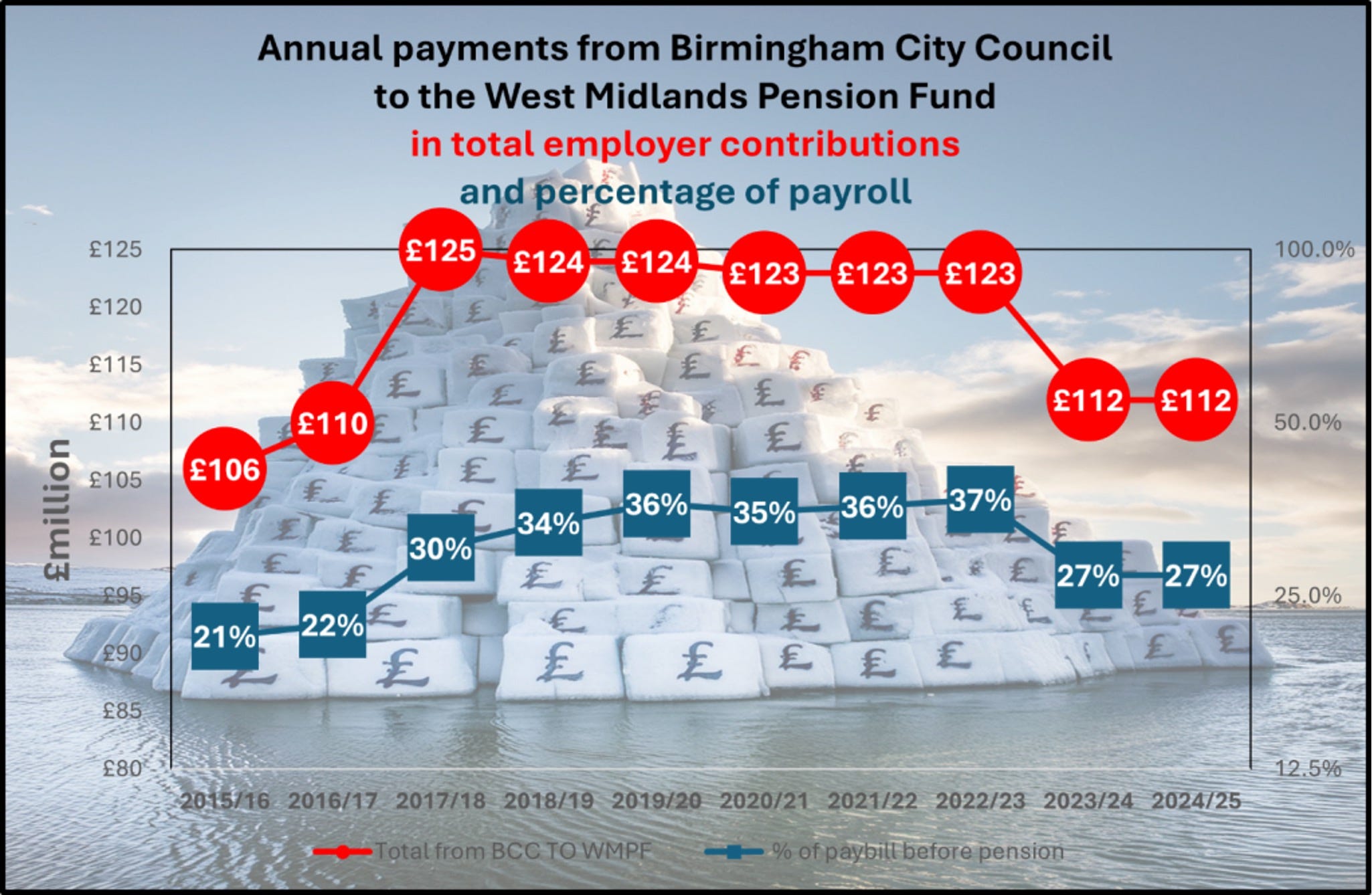

On 31st March 2025 it had assets £0.5 Trillion. But these assets are never used to pay pensions or retirement lump sums. That’s because the contributions of councils and current workers have more than matched those payments out of the scheme, since as far back as at least 2014.

A surplus in a defined benefit pension fund where employee contributions are fixed but employer contributions float, is owned by the employer. By definition, the employer was asked for too much in contributions. The surplus is legally public money/revenue and belongs to councils.

These funds were unnecessarily put at risk on the markets: they did not need to grow at the level they did. Safer de-risked assets which could have grown to, say £300 billion, was all that was needed.

The reason for this surplus was a series of calamitous prediction errors by the funds' managers and accountants. One error led to another which compounded to another.

In the case of the LGPS, every 0.1% out means you've miscalculated by £8 billion! Combine that with your obviously also related miscalculation in the short-term growth in your assets, and it can double. So you had better be right.

But they were wrong: very wrong.

Despite repeated warnings to ministry of local government (DHCLG), by us and other experts, the hapless, hopeless minister responsible, Jim McMahon MP decided to do nothing. Consequently, he chose bankers over councils and their budgets for 2025/2026. In Birmingham this led to £250M worth of cuts, particularly involving closures of day centers for the disabled, and inevitably it led to the bins strike.

Labour was bamboozled by The City and its own mandarins to look the other way, and carry on with the Tory policy which created this scandal in the first place under predecessors Javid, Jenrick and Gove (twice).

Worse, they bullied councils and pension funds with a bizarre letter which warned them not to even try to recover these surpluses, even though they were fully legally entitled to do so.

Deputy Prime Minister, Angela Rayner (who is Jim McMahon's boss) must now step in and return the £200billion surplus to revenue for the UK, and rescue the pensioners' scheme from the casino capitalism of the city.

We believe the fund should simply be brought back into the public sector as a pay-as-you-go-scheme (if necessary, notionally attached to the scheme), and the assets turned into a UK Sovereign Wealth Fund with £0.5Trillion in the tank, tasked with investing only in UK housing, UK infrastructure, and investing in UK businesses.

Full detailed blog here.

Research methodology summary here

.jpg)

John Clancy and David Bailey

John Clancy and David Bailey