Blogs from the Blackstuff

Professor John Clancy and Professor David Bailey

Blogs from the Blackstuff

Blogs from the Blackstuff

Blogs from the Blackstuff

By Professor John Clancy and Professor David Bailey

4th June 2025

Labour’s £200 billion blunder

One of the worst mistakes of any incoming Labour government.

A Scandal.

But first, the headlines:

One of the worst mistakes of any incoming Labour government.

A Scandal.

- £200 billion of spendable UK government revenue deliberately hidden in plain sight in a frozen iceberg of public money inside the Local Government funded pension scheme of 97 separate funds (LGPS).

- An incoming Labour government naively bamboozled by The City and its own mandarins to look the other way.

- Repeatedly and specifically alerted by experts, hapless, hopeless, out-of-depth Local Government minister Jim McMahon OBE does the will of the Whitehall establishment and City of London to effectively continue predecessor Gove Tory policy.

- In doing so, drags his Secretary of State Deputy Prime Minister Boss Angela Rayner into the mire, who was specifically warned last December and in January that the immense over-funding using taxpayers' money was happening; and that its obvious, dramatic, imminent escalation would occur in March 2025.

- Bizarre response to these alerts from MacMahon on behalf of Rayner was that it had nothing to do with them and he was going to do nothing.

- Freakonomics basic miscalculation by fund managers and advisers massively underestimated returns, and so badly miscalculated; hugely over-estimating liabilities, by using too-low Discount Rates; consequent excessive over-ask for employer pension contributions creates £200billion surplus. Even 0.1% miscalculation results in surplus increase of several £billion.

- In addition to the £200 billion surplus scandal, the Labour Government commits to paying a further £12.5 billion (which would, and still could, fund the winter fuel allowance for a parliament) to city financiers this parliament, instead.

- Councils which were plunged unnecessarily into effective bankruptcy should and could have been rescued, as they legally owned, and should have had access to, the £200Billion surplus.

- Huge hikes to council taxes everywhere completely avoidable.

- Birmingham bin strike directly caused, (and has continued) by and through this government failure to order surplus returns, and consequently backing its own financially illiterate government chief commissioner Max Caller in failing, and refusing, to heed specific local alerts as to the city's own impending likely £2Billion surplus.

- Whitehall Mandarins try to hide the incompetence by doubling down in classic Whitehall scandal management (as per the Post Office playbook) and effectively orders councils not to do what they were perfectly legally entitled to do under their own regulations: access their own pension fund surpluses.

- Over the last 10 years the attached now £500B asset base has effectively never been touched, as contributions by employers and employees have covered all of the pensions and retirement lump sums paid out each year

- The government's own statutory body, The LGPS Advisory Board, points out this month that the England and Wales funds' calculations are badly underestimating the reality of the markets, saying 'Longer term results remain well ahead of inflation and funds' actuarial assumptions'(i.e. wrong).Its own Government Actuaries Department takes a similar view.

- Average annual pension paid out last year from LGPS was £5,400, But average pension for the 75% of pensioners who are women was just £3600 per year.

- Best guess by government appointed body advising scheme is that 87% of the £500Billion fund is invested abroad.

- UK local government pension fund assets unnecessarily reach a value of £0.5Trillion - these funds can legally be brought back into public ownership without any loss to create a UK sovereign wealth fund which invests solely in the U.K.

- £0.5 Triilion pounds was carved out of the UK economy and effectively captured by the financial services industry and run for their needs.

- Scots part of the scheme already started to address the issue in 2023, but can still go further.

Part One - The big roll forward

On the 31st of March 2025 an extraordinary economic event occurred.

A pension fund, used to pay out tiny sums of money mainly to old women in poverty (£3,600 a year pensions), found itself with £200 billion more than it should have, due to a series of colossal, dunderhead, scandalous miscalculations.

Our research clearly indicates that the 97 local government pension funds In England, Wales , Scotland and Northern Ireland aggregated a total surplus on 31st March 2024 of an eye-watering........

We are able to roll forward from this data to reveal that on the 31st of March 2025 the assets of the 97 funds now totalled just short of £500 billion, and so the the aggregate total surplus of the 97 funds was

And counting….by the day.

We also stress that we use this figure as a baseline and it should be even higher, but we are using lower-end, conservative estimates, as the funds themselves will inevitably do this.

They will continue to do so, unless there is external intervention. This, even though all of the recent evidence from both the government's own actuaries department and its statutory body set up by DHCLG – The LGPS Advisory board - have shown them to be have been consistently wrong in their estimates.

From the early 2010s years of the coalition government, it was clear that that the local government pension funds were coming up with Freakonomics-style, nonsensical liabilities based on calculations emerging from a non-functioning market (saved by public sector intervention) where interest rates were near or below zero. A floor should have been placed by DCLG of 7% in the funds' calculation of medium to long-term estimated investment returns, because that's what they based the calculation of the funds' liabilities on.

Even more so was a 7% floor required, when COVID and Ukrainian war inflation hikes hit in the early 2020s - as the same dimwitted miscalculations were ridiculously repeated and compounded.They effectively stupidly calculated that the next two decades would only ever return about 4.5% per year. Well, they were just wrong.

And as we can see from above, even with the biggest financial crash in history in 2008, and Covid followed by huge inflation spikes, the funds had still returned more than 7% a year over the previous twenty years. Why wouldn't they in the next two decades?

They also call this estimated figure for medium-to-long-term investment returns 'the discount rate'. The problem is, if you get this figure wrong, even by a bit, it has dramatic consequences:

In the case of the LGPS, every 0.1% out means you've miscalculated by £8 billion! Combine that with your obviously also related miscalculation in the short-term growth in your assets, and it can double. So you had better be right.

But they were wrong: very wrong.

A pension fund surplus is owned by the employer

As we shall explain further in following blogs, the law is crystal clear: a surplus in a defined benefit pension fund where the employee contributions are fixed, but the employer contribution floats, is in the ownership of the employer, i.e. in this case, council/government/taxpayer. By definition, the fund asked the council for too much over many many years, so it's their money.

Perhaps counterintuitively, a surplus in a defined benefit pension fund is a very bad thing indeed. By any standards, a surplus of almost £200 billion is a catastrophe, and literally a waste of taxpayers' money.

The big payday

We can also reveal that during this parliament these funds will deduct from their assets and hand over £12.5 billion pounds in management expenses almost entirely to investment bankers. That in itself is a scandal. The Labour government intends this to happen, despite warnings from us.

A £200 billion surplus made up of frozen taxpayers' money and £12.5 billion to investment bankers.

Sometimes a mistake, a scandal, of this magnitude is missed precisely because it is so huge it couldn't possibly be true, could it?

This was taxpayers' money.

It still is taxpayers' money - stashed away, initially gradually, so as not to be noticed , but then explosively, and noticed by only a few.

We can further reveal that the local government pension scheme's £500 billion pound asset base isn't actually ever used to pay out pensions or retirement lump sums!

Since April 2014 all of the pensions and retirement lump sums paid since have been covered by the contributions coming into the scheme across the UK, from employers and employees.

In practical reality, the £500B asset base is only ever really used to have deducted from it £billions of management expenses each year, and to be fed upon by the financial markets of the world. Bizarrely, the scheme could get on perfectly well without it, as a pay-as-you-go pension scheme.

That's the calamitous state of affairs the contributions and miscalculations chaos has caused.

Part Two – The unheeded alarm bells

In its Spring 2024 report, the statutory LGPS Advisory Board had already pointed to the £21billion surplus in England and Wales in the 2022 triennial valuations reporting in early 2023.

Alarm bells had similarly been sounded in summer 2024 by expert pensions actuaries firm Isio. They had advised immediate action by the 97 pension funds to deal with the then fast-growing surpluses and what they saw as the obvious oncoming even bigger surplus in 2025. They advised an immediate start to the process of returning the surpluses to the councils.

They specifically advised against waiting until 2026 to sort the crisis out.

This is exactly what the hapless, naïve incoming Labour government sadly did.

Pensions Actuaries LCP similarly agreed that things had gone badly wrong, and confirmed Isio's analysis as aligning with theirs.

So everybody knew what was going to happen, apart, apparently, from the funds themselves and the dimwits at DHCLG.

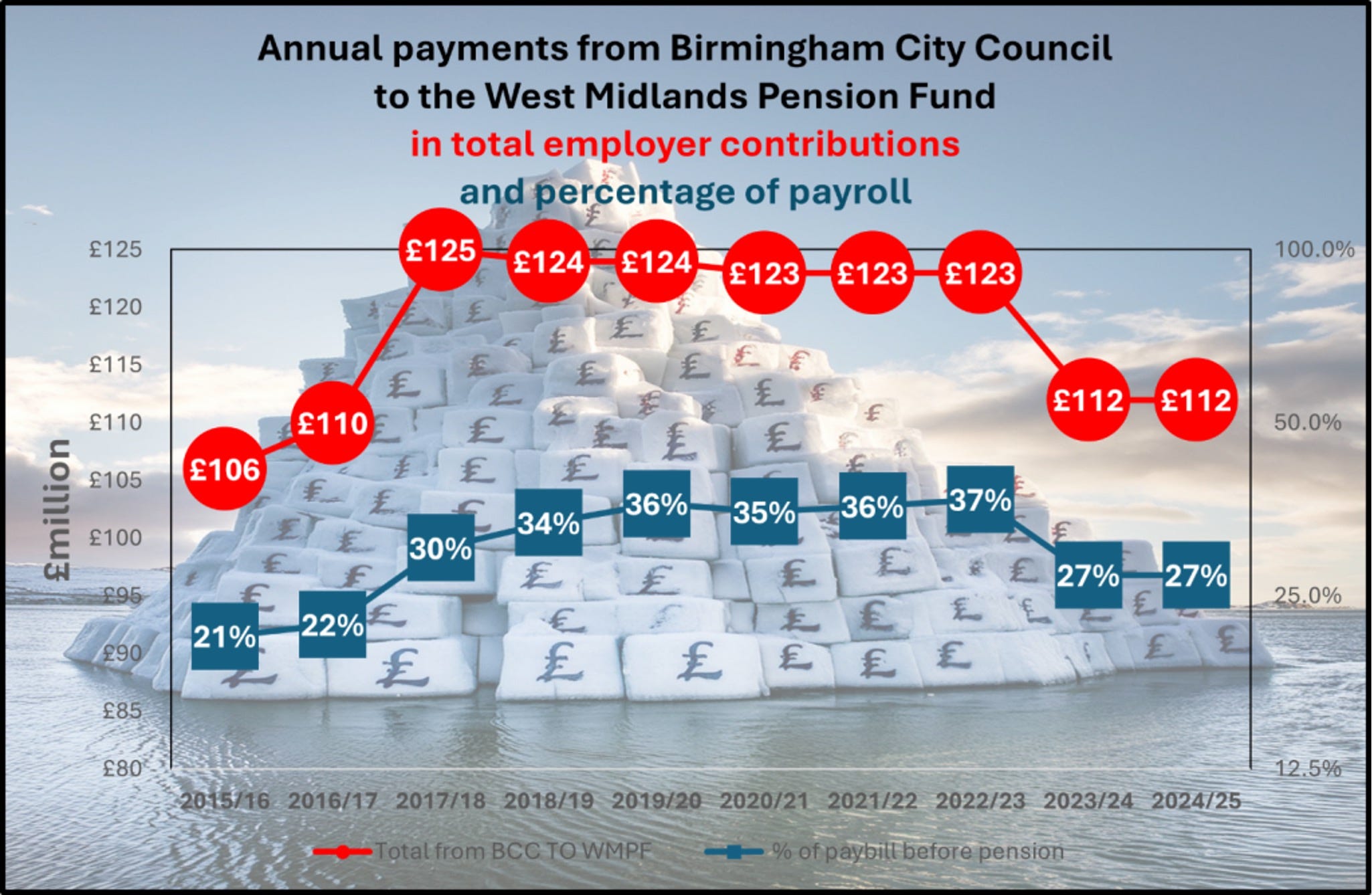

In December 2024 we published research which showed the absolute chaos occurring in the UK local government pension scheme; how unsustainable extra contributions demanded by funds (even while it was obvious surpluses were emerging) had impacted on Birmingham, as the biggest council in the country, in particular.

We warned then that the entire system was turning into a fiasco and would need immediate, decisive intervention by government, because the councils and funds would not do this themselves - they would just watch the car crash happen.

As the funds' annual reports started to come in during October and November, even the (ironically now lower) accounting liabilities aggregated from all 97 funds were showing a clear and undeniable surplus of £71billion at March 31st 2024 - a simple matter of deducting the aggregate of each fund's declared accounting liabilities from the total declared assets. So we had a baseline already declared. But DHCLG did not publish this figure in its collation of the thousands of datapoints returned by its 87 England and Wales funds, at the end of October 2024.

We warned, to no avail, that the government needed to take action before the new financial year when budgets were to be set by councils, and there was still time to do so.

We advised that the government's own financially illiterate Birmingham Chief Commissioner, Max Caller, who was running Birmingham then, and now, needed to start to nail down the huge surplus and get it returned to revenue before it was too late. Because the biggest U.K. council was Birmingham, and so it would have the biggest surplus, fast-heading towards £2billion.

He publicly ridiculed the idea. So this warning, too, was to no avail. And all that has happened in Birmingham since followed from this. Most especially £250M cuts and the Bin Strike

What the councils and the pension funds themselves failed to understand (but which the Whitehall Mandarins were all too aware had to be misunderstood at all costs) was, as we wrote earlier, that the legal position is crystal clear: a pension fund surplus is owned by the employer . That's whether it is in the public or private sector.

In this case, the council owns it.

In January 2025, in the absence of DHCLG taking notice, we wrote directly to the Deputy Prime Minister Angela Rayner (as did Birmingham MP Ayoub Khan) warning her of the gathering storm. Jim McMahon MP, the local government minister, replied to say it had nothing to do with them, and they were going to do nothing.

The rebellion and the Mandarin double down

Then another key event occurred: a London borough pension fund broke from the pack and rebelled. The Royal Borough of Kensington and Chelsea (RBKC) pension fund subcommittee simply voted to reduce their council's employer's pension contributions for this year immediately to 0%.

The chair of the committee who happened to be a London financier spotted that they were in surplus (having, by the way, simply put the fund in a tracker). There were 224% funded. They had more than double the assets they should have.

This sent shockwaves through the entire local government pension fund industry. But the biggest shockwave hit Whitehall Mandarins at DHCLG. Because the game was up. They knew this was going to start to happen across the United Kingdom. A scandal would erupt as to how this happened in the first place. They owned this - along with successive previous secretaries of state: Javid, Jenrick and Gove (twice).

As usual in Whitehall scandal management, rather than 'fessing up, they simply doubled down, and hunkered down.

They sent a bizarre letter to every council and pension fund In England and Wales warning them against doing anything.

As they knew the biggest surplus would occur in the biggest city, Birmingham, they effectively cleared their chief commissioner there to prevent Birmingham from going down the same road, as the reason for the intervention in the first place would clearly have been blown out of the water.

The letter was galactically stupid, it basically implied the regulations did not allow for surpluses to be returned between three year valuations (inter-valuation refunds). They did, of course.

Comically, they made it clear that the regulations were not intended to allow this, and that they were consulting on making those regulations even more clear that they were not permitted.

The problem for them was that the regulations were the regulations, and none of the Mandarins' lawyers had explained to them that judges are not allowed to interpret the law or regulations based on what the intentions of the lawmakers were. And section 64A of those regulations very specifically allows councils to request a recertification of their contributions between valuations.

So this was simply bullying by Whitehall Mandarins of councils who would obviously then fear intervention by commissioners for doing what they were perfectly legally entitled to do; and in any event they were entitled to recover the surpluses even outwith the regulations as a matter of law.

We can only assume that the mandarins hoped, as Toby Nangle of in the financial times had pointed out, that the pension funds would have time to do their thing and 'tweak' the figures to find liabilities from somewhere under the carpet, which could significantly reduce the surpluses.

In our letter to the deputy Prime Minister, we specifically requested that she should, as she was clearly empowered to do, order immediate inter-valuation recertification and refunds. Her mandarins stalled and when challenged by reporter Mark Gough at ITV News Central they told him that she had no such powers.

Again,in Jim McMahon's reply to us as Minister of State he said they were going to do nothing.

When asked what they were going to do about the £12.5 billion to be deducted from the funds in management expenses this parliament, answer came there none.

Labour's £200 billion pound blunder occurs

So an incoming Labour government passed up the chance to right this wrong and have £200 billion of revenue returned to UK National and local government. They could, quite correctly have blamed the Tories for failing to correct the pension funds, and set a floor in the interest rates they were using to calculate their liabilities. Instead, they decided to carry on Gove's policies which enriched the City of London but not councils or pensioners.

Much has happened since which has harmed the reputation of the incoming Labour government and it is directly linked to their failure to appreciate the seriousness of the situation.

And how different might their fortunes in the opinion polls, and at the actual polls, have been had they heeded the alarm bells; and found £200 billion down the back of the LGPS sofa.

Whilst the inaction could have been expected by one of the doyens of the local government establishment, Jim McMahon MP OBE, and successive permanent secretary Mandarins, this has been an unfortunate misstep by Angela Rayner, probably unintended. She no doubt believed that she could rely on her Minister of State For local government.

After all, her key role in government was in respect of housing and as Deputy Prime Minister. She was likely assured by her junior Minister of State and her mandarins that this was simply the minutiae of local government. It's clear she should not have relied on the hapless, hopeless McMahon.

Nevertheless, she could still justifiably blame this on him, and turn it to her advantage. Indeed, she could hand the winter fuel allowance funding to the prime minister by placing an Immediate cap on her own local government pension scheme management expenses for the rest of this Parliament, and claim the credit for finding the money.

In our next blog we will be explaining how these funds can be returned to public ownership in their entirety in order to create UK sovereign wealth fund which invests solely in UK housing, UK infrastructure, and UK businesses.

The 97 funds, so far as the government is aware through its LGPS scheme advisory board, invests only 17% of their £500 billion assets in the UK. That's a scandal in itself.

And half of that is in stocks and shares in the UK stock Exchange that aren't necessarily those of genuinely UK-based companies.

A UK Sovereign Wealth Fund apparently from nowhere will be quite a scalp for Angela Rayner; or perhaps Rachel Reeves or Keir Starmer, if they move quicker.

And if Labour passes on this yet again, might there not be somebody else a bit more interested in setting up a MUGA Sovereign wealth fund? To Make the UK Great Again investing £0.5 Trillion in only UK housing, UK Roads, UK infrastructure and British and Northern Ireland businesses?

Research methodology summary here

.jpg)

John Clancy and David Bailey

John Clancy and David Bailey